The only expense tracking method that worked for me

Saving money doesn't have to be complicated. Using an envelope approach can be the key to your success.

I wish I had taken my finances more seriously when I had my first job. We didn't have a financial literacy course in school and money was not a topic discussed often. When I did start taking my finances seriously I struggled to find a system that worked for me. There are many apps available, some for free. There are even free google sheets to help you track your spending and financial health. I couldn't stick to any of them for longer than a couple weeks.

Tracking Spending

I tried apps like Mint as well as creating my own spreadsheets. Then I found an app called Goodbudget that changed how I tracked my spending. I'll preface the following by saying this is not sponsored by Goodbudget or by anyone for that matter.

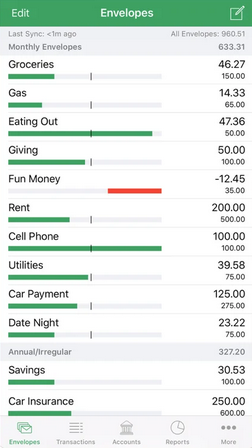

Goodbudget allows you to add your income sources and amounts. Then you create "Envelopes" for categories of spending with a set limit. Then when you add an expense, you select a category and the amount is deducted from the envelope. While there are options to import expenses, I decided to go manual. This was key for me to be mindful every time I made a purchase. It also helped me track how much I had left for each category.

I chose broad categories to reduce over-thinking, especially as I'm entering an expense. I then set a target for each category based off best guesses or in some cases I knew the amount. Here are my categories:

🌮 Food & Drinks

🎬 Social

🚕 Travel

🛍 Shopping

🍿 Subscriptions

📱 Phone

🏚 Rent

🤷 Misc

Any recurring expenses I placed in envelopes: phone, rent, and subscriptions. I set Goodbudget to automatically deduct the amounts on a certain day each month. Food & Drinks is for anything food related: restaurants and groceries. This helped keep my eating-out in check. Social is for going out, like to the movies or to a conference. Travel is for public transit or taxis/Uber/Lyft. Shopping is for any clothing or items for the house or myself. Anything that didn't fit into a category, I placed in Misc. Here's a screenshot of the app from the App Store.

As soon as I made a purchase I would add it to the app. Sometimes I'd check the app before buying to see if I'll stray off track. This system worked for me and I was able to stick with it. From my first month I saved double what I normally was saving before.

If you'd like to give this a try, here are my tips:

- Add your income(s). Set it to fill your account automatically at your regular pay schedule.

- Create your initial set of envelopes. Start with broad categories. Add envelopes for recurring expenses and set them to deduct automatically at their regular intervals.

- Set an expense limit for each category, To start, estimate how much you spend in a day for the category and multiply by 30 for the month. Make sure to add a little extra just in case. Nothing is more demotivating than constantly running over budget.

- If at this point your category limits are larger than your income, congratulations you've already taken the first step to financial literacy. You should spend time to determine where to cut back, and set that category's limit accordingly.

- As soon as you make a purchase, immediately add it to the app. Worst case, add it at the end of the day.

- Stick to tracking for at least 1 month.

- At the end of each month, see how you did by reviewing your categories. Adjust any limits, or better yet, adjust your spending.

One note, you'll need to refill your envelopes each month. You can choose to carry over last month's positives/negatives, or you can set them to start from their set limits.

Adjustments

Getting it right the first time is hard. Don't fret, oftentimes you just need to make small changes.

If you find you're not sure where your money went at the end of the month, you may need to split your categories further for a detailed picture.

If you're constantly exceeding a category's limit, either you're spending too much (so cut back!) or you might need to adjust the limit as you figure out your true spending for a category.

If you're using a "Misc" category often, you might not have enough categories or again you may be over-spending.

My aim was to level-set with my spending/saving then decide on any adjustments. I wanted ensure I'm meeting my financial goals. Tracking expenses is actually very rewarding, especially when you see the rising bank balance.